Doing More with Less: The State of the DEC Industry

By Jessie Fetterling

There’s a common sentiment in the Detention Equipment Contractor (DEC) market that mergers and acquisitions have made it a significantly different industry than it was five years ago. That combined with a steady upsurge in projects that have had to rebid due to budgetary issues and constraints means that there are fewer companies providing services to more.

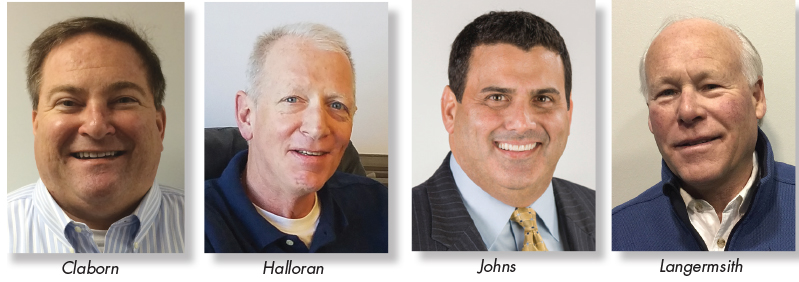

In this DEC Roundtable, Correctional News spoke with Mitch Claborn, president and CEO of Cornerstone; Don Halloran, president of Southern Folger Detention Equipment Company; Buddy Johns, president and CEO of Argyle Security; and Michael Langersmith, founder and executive director of CML Security, to get a pulse on the current DEC market and what the future holds.

Q: How is this change in the marketplace affecting the way you do business?

Claborn: The reduction in suppliers has required us to seek out partnerships for certain products and new manufacturers for other products.

Halloran: Due to fluctuations in the market, we have had to diversify in various sectors of our business using our manufacturing capabilities to offer a wider breadth of detention products. The most notable change has been the acquisition of Southern Folger Detention Equipment Company by Coastal Detention Holdings (CDH) in June of this year. Anytime there is a significant change in the market, we must re-evaluate our current business models and streamline our procedures and processes to fit the current needs of the market. We have recently reorganized our construction management division, and have developed more efficient systems of delivering project management services.

Johns: Supply reduction has created a need to be more creative in our service delivery. There is less margin for error now than ever; therefore, creative thinking, preparation and planning must all be continuously enforced.

Langersmith: It’s made us really appreciate the good suppliers that we have. That’s been a blessing for us because the consolidation just so happens to be with companies we’ve been doing business with for 25 or so years. We have always sought quality, and I think the consolidation reflects that, as the companies that provided better quality are the ones still in business. As far as our business changing, it hasn’t changed much because we’re working with the same suppliers we always have. We’ve always seen cycles in this marketplace. There was a period when there were longer lead times, but things are settling out now. The capacity is there for the manufacturers. Where we struggle is getting the information finalized from the owners and architects. The approval process is nearly equal to that of manufacturing, and what we’re striving to do as a company is to cut down on the approval time to meet ever-demanding schedules.

Q: Can you provide an example of new things you’ve had to consider as a result of these changes?

Claborn: Due to a lack of shop capacity for steel prefabricated cells, we developed strategic partnerships to farm out the assembly of the cells. This allows us to meet the product shipping demand, and by selecting these locations strategically, we can gain a competitive advantage.

Halloran: We’ve had to consider acquisitions and mergers to achieve synergies, growth and versatility. [That includes] furnishing our over 400,000 square feet of combined manufacturing space with state-of-the-art equipment and technologically advanced automation ability as well as implementing ERP systems that coordinate engineering, manufacturing, administrative and project management capabilities within and across all our companies.

Johns: Planning product delivery has changed from when the project needs the material to when the manufacturers can fit it into their production schedules. This forces us as a DEC to find ways to mitigate delivery risk by accepting and storing materials months in advance rather than just in time. This extra cost is a reality as to not incur the much higher costs of late delivery. We cannot allow product delivery to negatively affect a project schedule.

Langersmith: It’s created a different type of competitive atmosphere, where we’re competing against systems more than we used to. The architects, engineers and general contractors are aware of the dynamic, so what they’re doing in response to this is having us bid a product system against another before the design is finished. So, the competition is happening earlier in the design phase, and the designers are designing as a result of the systems that are selected early in the project. That’s the new norm.

Q: Specifically, how does the industry’s focus on rehabilitation affect the DEC market?

Claborn: It has very little effect on our business.

Halloran: We are in the process of developing more aesthetically pleasing products that might facilitate in the rehabilitation process. An example of this is Trussbilt’s wood-grained security door, which has the appearance of a wooden door but the strength of a detention hollow metal door.

Johns: We have to be able to expand our product lines to include the normalized products demanded by this market. In addition, our crews are being trained to deliver a much more enhanced and commercially acceptable finish. This is not difficult as our market has always handled higher-end finishes, by example of the courthouses; however, the quantity of this effort creates a need for more finish quality–skilled installers than we have needed historically.

Langersmith: It’s created a need for firms like ours to understand normalized environments, yet still make them secure. The security aspects aren’t as obvious as they used to be. It certainly creates less of a demand for the hardened cells, but it’s the right thing to do. Not only is it good for the inmate, but it’s also good for the staff. We see that this is a real opportunity to be creative.

To read the entire article, check out the November/December issue of Correctional News.